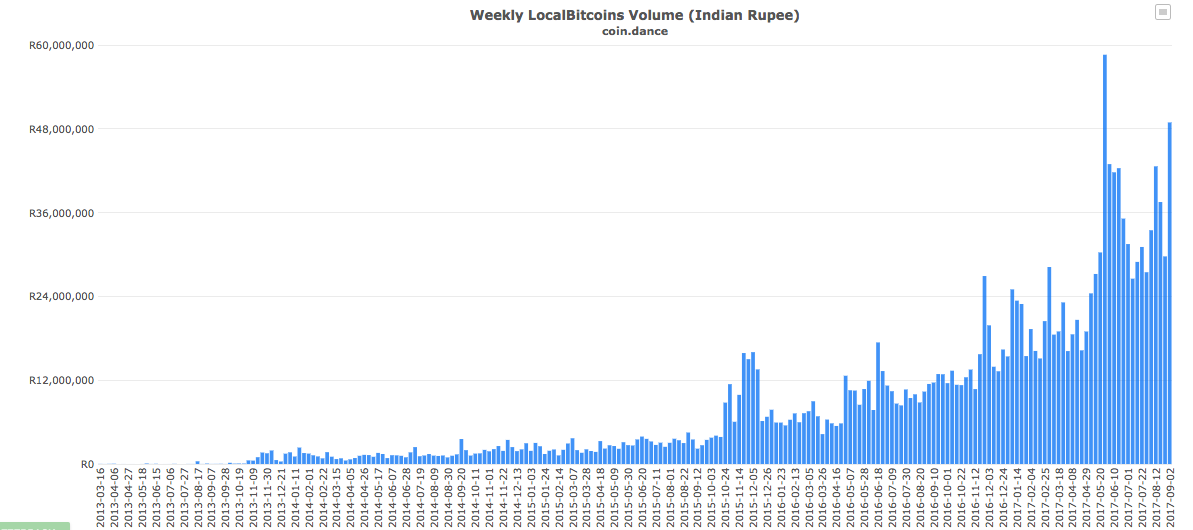

The following chart from Coin Dance, which tracks bitcoin trading in multiple countries, shows how the momentum has picked up in India – a nation of 1.3 billion people which is in the midst of a digital transformation.

Source: Coin Dance.

Blockchain – a six-year-old company based in London and New York, which takes its name from the blockchain technology underlying the digital currency – today announced its entry into India through a partnership with local bitcoin exchange Unocoin. “India is one of the top contenders for becoming the largest market for cryptocurrency,” Blockchain president Nic Cary tells me.

The four-year-old Unocoin is one of the more popular cryptocurrency exchanges in India, enabling its 400,000 users to buy, sell, and store bitcoin in wallets. The partnership with Blockchain, which has 16.5 million users with wallets, widens the scope for trading. It also promises to make transactions faster and more robust as Blockchain has a presence in 140 countries, with billions of dollars in wallet activity.

Another point of interest to Indian users is that the partnership will let them exchange bitcoin for ethereum. Blockchain deals in both cryptocurrencies, unlike Unocoin which trades only bitcoin. A user can buy bitcoin through Unocoin, then trade it for ethereum on Blockchain, explains Cary. That way, investors in cryptocurrencies won’t be putting all their eggs in one basket.

Bitcoin and ethereum rates tumbled by 20 percent and 30 percent respectively after China banned ICOs (initial coin offerings) – a new way for companies to raise funds in exchange for digital tokens which can be traded. The Chinese government felt this unregulated form of fundraising risked huge scams and consequent social disorder.

Cary is unfazed by the slide, which appears to have leveled off. Such ups and downs have been par for the course in his four-year journey since taking the helm at Blockchain. But it does underscore the impact that new regulations could have on cryptocurrency wallets, exchanges, and users.

Nevertheless, the security and regulatory issues around bitcoin and ethereum are just as much a matter of debate as the potential of the cryptocurrencies to disrupt traditional modes of payments, savings, and banking.

No comments:

Post a Comment